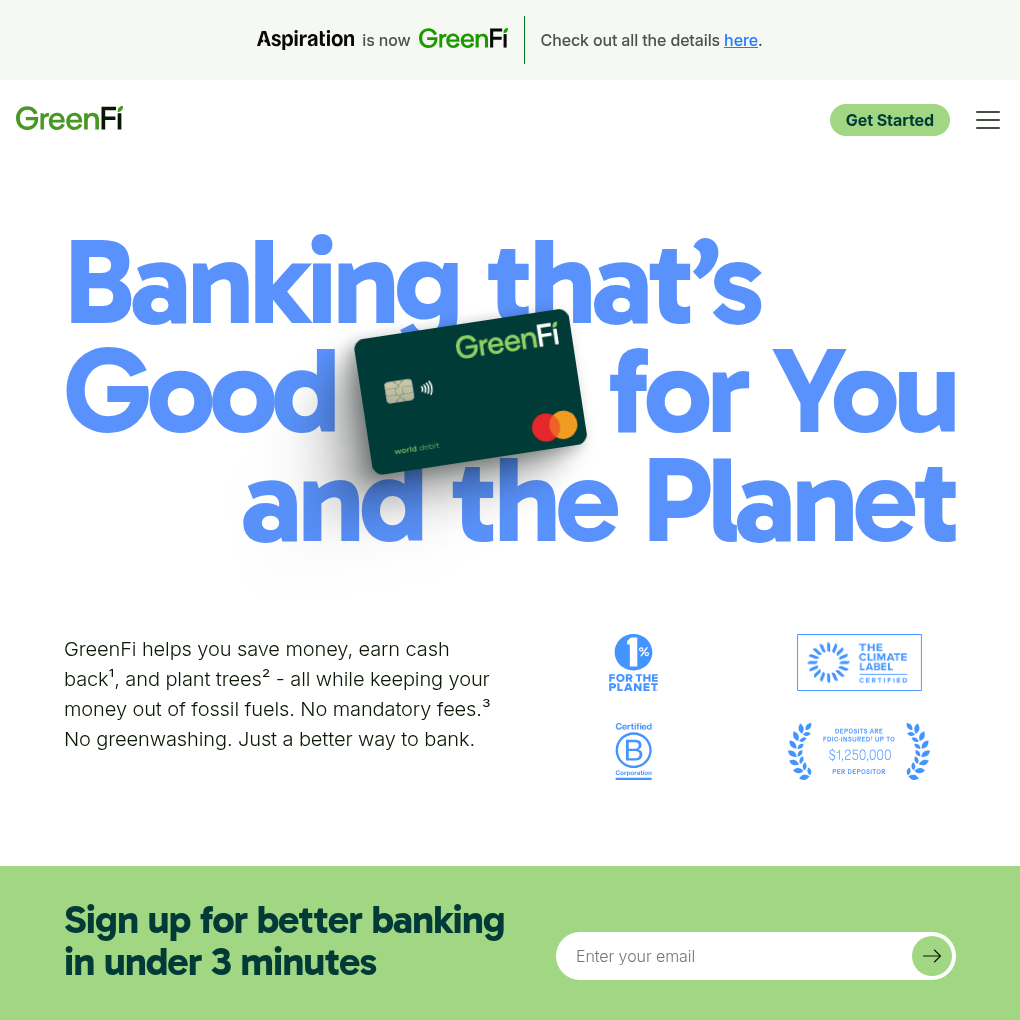

What does GreenFi do?

GreenFi is a climate-friendly banking and investing brand based in San Francisco that empowers customers to align their financial goals with their environmental values by offering sustainable financial solutions.

How much did they raise?

The company raised $17M in funding with undisclosed backers following its emergence as an independent entity after the acquisition of Aspiration’s consumer fintech brand by Mission Financial Partners.

What are their plans for the money?

GreenFi plans to use the funds to accelerate the development of new banking, credit, and investment products, including higher-yield savings accounts, climate-friendly credit cards, green loans, and impact investments, potentially transforming the landscape of sustainable finance.

What have they achieved so far?

The spin-out from Aspiration’s consumer fintech brand and the leadership of founder Tim Newell, formerly with Tesla and Aspiration, have positioned GreenFi as a pioneering force in sustainable financial innovation.